I’ve had a hard time understanding what actually happened during the financial crisis of 2007-2008. I think I understand some of it, like the role of rating agencies. Read further to see if it makes sense to you as well.

The credit rating agencies (namely Standard & Poor’s, Moody’s and Fitch) gave AAA rating to mortgage-backed securities which are simply financial instruments that allowed investors to bet on the likelihood of someone else defaulting on their home. ^^AAA rating is usually given to world’s most solvent governments and best-run businesses.

Investors were told, for instance, that when it rated a particularly complex type of security known as Collateralized Debt Obligation (CDO) at AAA, there was only a 0.12% chance that it would fail to pay out in the next five years. In fact 28% of these CDOs defaulted. This meant that actual default rate was 200x higher than what was predicted. These agencies tried to blame the housing bubble which they did not see coming. Even though the bubble was discussed frequently in public, they claimed to have missed it when it was explicitly their job not to miss it. It’s now believed that they knew. They just didn’t want to see it.

The ratings agencies were paid by the issuer of the CDO every time they rated one: the more the CDOs, the more profit. A virtually unlimited number of CDOs could be created by combining different types of CDOs into derivatives of one another. They rarely turned down an opportunity to rate one. Rating agencies had no track record for CDOs, these were new securities and their huge error could only be explained if fault lied with the statistical models used. And indeed that was the case as explained through this simple example.

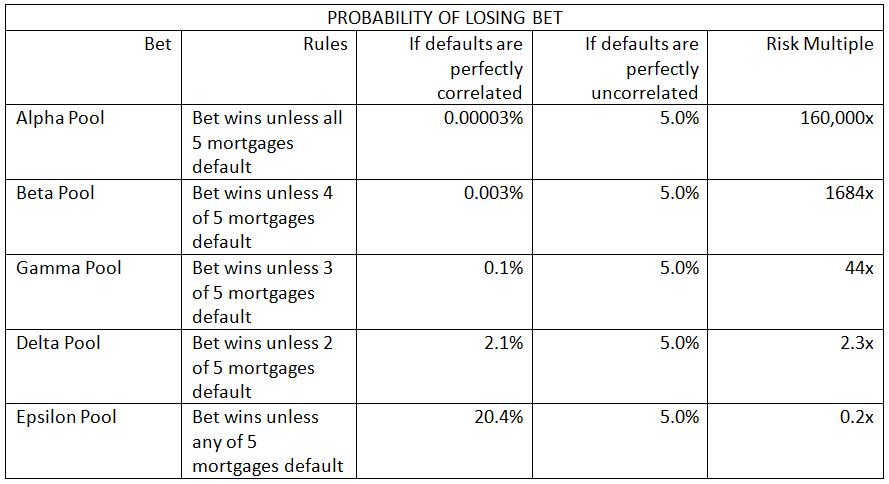

Assuming there are five mortgages, each of which has a 5% chance of defaulting, one can create a number of bets based on the status of these mortgages. The safest of these would be Alpha Pool that pays out unless all 5 default. The riskiest, the Epsilon Pool pays unless any 1 defaults. An investor would choose epsilon pool as it would be cheaper to account for the risk. If the investor is risk averse, such as a pension fund, then definitely alpha pool will be bought.

The math for the above cases is pretty easy

What are the risks associated with each pool? The answer actually depends on the assumptions and approximations chosen. One assumption could be that each mortgage is independent of each other (reasonable if the economy and housing market are healthy). Defaults are going to happen from time to time because of unfortunate rolls of the dice. On the other end mortgages behave exactly alike (reasonable if some common factor like a housing bubble exists that ties the fate of homeowners together). This diversification allowed rating agencies to claim a group of subprime mortgages that had just a B+ credit rating to have almost no chance of defaulting.

Housing market is a fairly small part of the financial system then how did this snowball into a crisis? Easy, leverage. For every dollar that someone was willing to put in a mortgage, Wall Street was making almost $50 worth of bets on the side. The rest is history. If this sort of thing interests you, you might want to read ‘The Signal and the Noise-Why So Many Predictions Fail But Some Don’t’ by Nate Silver.